Monash IVF Group (ASX: MVF) has rejected an indicative $312 million acquisition proposal from a consortium comprising healthcare sector specialist private equity firm Genesis Capital and investment company Washington H Soul Pattinson (ASX: SOL).

The consortium, which currently holds a stake of around 19.6% in Monash, offered 80 cents per share to acquire the rest of the shares and sought exclusive due diligence.

Monash rejected the “opportunistic, unsolicited, conditional and non-binding indicative proposal”.

In a 24 November ASX announcement, Monash said its board had considered the proposal with the assistance of its financial and legal advisors and had unanimously determined that it materially undervalued the company. It said the offer price was at a substantial discount to comparable IVF transactions in the Australian market. The implied equity value to underlying 2025 financial year EBITDA (earnings before interest, tax, depreciation and amortisation) multiple was 7.7%.

Chairman Richard Davis said: “The board will act in the interests of shareholders as a whole and will consider any change of control proposals that it receives but will only progress such a proposal if it believes it represents compelling value for Monash IVF shareholders.”

Monash has appointed Macquarie Capital as its financial adviser and Clayton Utz as its legal adviser.

Also on 24 November, Monash reported the Genesis-Soul Patts consortium had become a substantial shareholder with up to 76,367,969 shares.

Soul Patts acquired 37,767,969 Monash shares (9.69%) on 23 September.

The announcement of the consortium bid sent Monash shares up almost 33% from 61 cents to 81 cents in early ASX trading on 24 November.

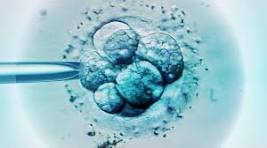

Monash has suffered a decline in patient numbers and financial performance in the wake of reporting two embryo implantation errors. In April, the company said an error had resulted in a patient giving birth to a different person’s baby. In June it disclosed that a patient’s own embryo had been implanted although the treatment plan stated she should have received her partner’s embryo.

A subsequent investigation confirmed human error had resulted in the mistakes. In 2024, Monash paid $56 million to settle a class action brought by more than 700 former patients who had alleged it used inaccurate genetic testing and, as a result, had destroyed potentially viable embryos.