Monash University has formed its own venture capital firm and launched a $15 million pre-seed fund to help finance and nurture companies spun out from technologies developed at the university.

The Monash Ventures Pre-Seed Fund has been established under the Victorian state government-financed Breakthrough Victoria University Innovation Platform.

Monash Ventures, which will administer the fund, is a new initiative to manage commercial development of technologies developed at the university.

The pre-seed fund will provide up to $1 million per company. Alongside providing capital, Monash Ventures will help companies gain access to expert networks, provide mentorship and support. The Monash Ventures team will also assist portfolio companies advance proof-of-concept projects and de-risk technologies as they prepare to seek further investment.

Launching the project, Monash University Vice Chancellor Professor Sharon Pickering said: “At Monash we are committed to transforming outstanding research into tangible outcomes that benefit our communities, our economy and the world. The launch of Monash Ventures and the Monash Ventures Pre-Seed Fund marks a bold step in strengthening our impact through innovation and enterprise.”

Deputy Vice Chancellor (Research and Enterprise) Professor Robyn Ward, AM, said: “The fund ensures innovators are supported at one of the most challenging points in their journey − turning ideas into investment-ready ventures. By supporting our spinouts with early-stage investment, we are creating pathways for researchers to take their transformative ideas to the market in pursuit of significant impact.

The university’s Chief Commercialisation Officer, Dr Alastair Hick, said the Monash Ventures team would provide company formation assistance for each spinout and would help them develop commercialisation strategies.

Allocation of funding will be decided by an investment committee comprising representatives from the university, Breakthrough Victoria and external industry experts.

“Providing access to pre-seed funding is key to enabling Monash-founded companies to grow, build momentum and attract follow-on investment,” Hick said. “This launch sets the foundation for a new era for venture creation and impact from Monash.”

Three spinouts have received inaugural investment from the fund:

- FytonBio, developing therapeutic antibodies that deplete disease causing immune cells, with a focus on inflammation and autoimmune diseases.

- Remagine Labs, developing an engineering wearable, electronically controlled, transdermal drug delivery system for people living with chronic conditions.

- Myostellar, creating regenerative therapies that stimulate skeletal muscle growth while minimising fibrosis, with a focus on treating muscular dystrophies.

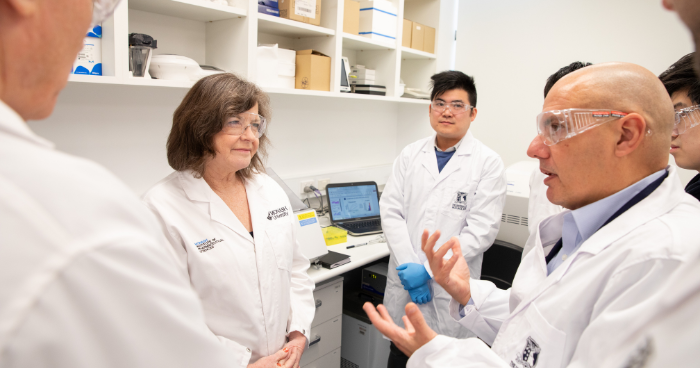

Image: Professor Stan Skafidas of Remagine Labs explaining the spin-out’s objectives to visiting federal assistant minister, health and aged care, Ged Kearney.