Church donations and communications software company Pushpay (NZX/ASX: PPH) has negotiated a 6% increase in an acquisition offer from Melbourne private equity firm BGH Capital and US investment firm Sixth Street.

The new offer values the company at $NZ1.666 billion.

Under the revised offer, announced by Pushpay on 16 March, shareholders will receive $NZ1.42 per share cash, up from $NZ1.34 per share. The increase does not apply to shareholders who had already agreed to accept the lower offer.

Announcing the increased offer on 16 March, Pushpay said seven of its largest New Zealand-based shareholders, six of which had voted against the earlier offer, now intended to vote in favour. This group represented, in aggregate, 18.6% of the company’s shares.

Pushpay said “a small number of sophisticated professional offshore event-driven fund shareholders” had agreed to receive the earlier offer of $NZ1.34 a share. They held 10.3% of the company.

The bidding entity has entered into agreements to acquire, at the increased price, shares held by New Zealand Accident Compensation Commission (ACC), New Zealand Superannuation Fund Nominees (NZ Super), ANZ New Zealand Investments, Fisher Funds, Nikko Asst Management and Salt Funds Management. In addition, Mint Asset Management has stated it intends to vote its shares in favour of the new offer.

A new meeting is to be scheduled to vote on a revised scheme implementation agreement which will result in Pushpay being acquired under a scheme of arrangement.

Pushpay directors, excluding John Connolly who is a senior adviser to Sixth Street and did not participate in discussions on the bid, have advised shareholders to vote in favour of the revised offer in the absence of a superior proposal.

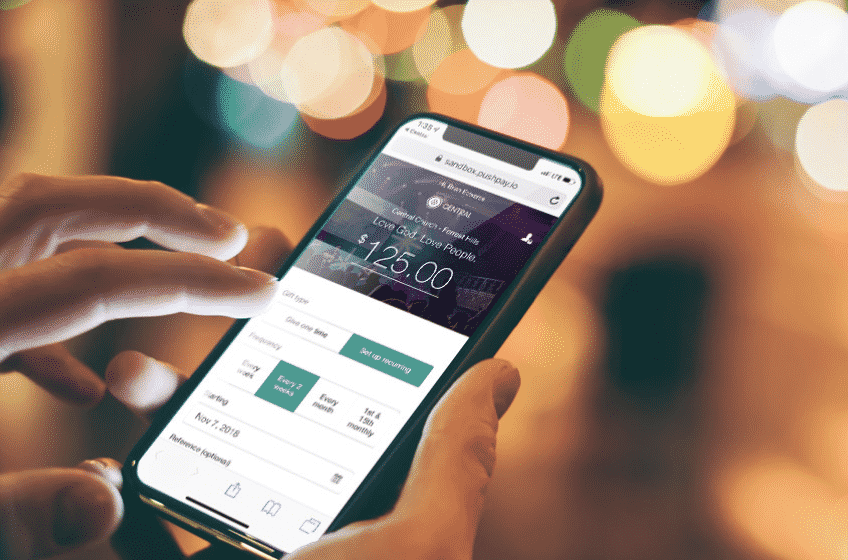

Image: Pushpay’s technology makes it simple for members of faith communities to donate.