The board of messaging software company Whispir (ASX: WSP) has unanimously recommended shareholders accept a $74.39 million 55 cents-per-share bid for the company from Soprano Design, in the absence of a superior proposal.

Soprano, which also provides messaging software, is an investee of technology specialist private equity firm Potentia Capital.

In a January 8 announcement, Whispir said discussions with another rival messaging software company Pendula had ended so no superior offer was now likely to be received. Pendula, an investee of B2B software-focused venture capital firm EVP, had earlier made an indicative 57-cents-a-share offer for Whispir.

Whispir recommended shareholders to promptly accept the Soprano offer which was scheduled to close at 7pm Sydney time on Wednesday 10 January.

Soprano’s 55 cents-per-share offer was increased from an initial 48 cents-per-share which Whispir rejected in early December.

Prior to launching its bid, Soprano had quickly built up a 15% stake in Whispir.

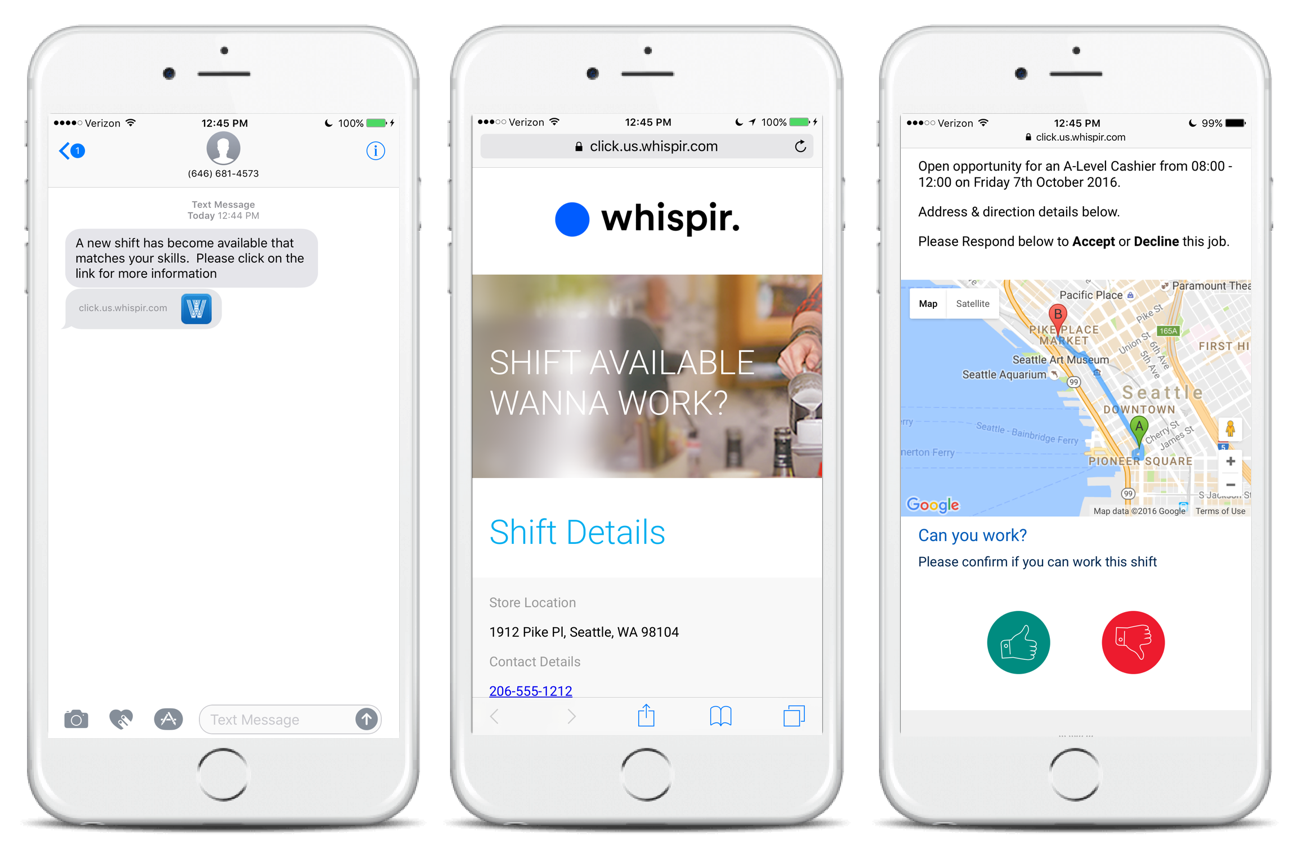

Melbourne-based Whispir offers a software platform with a no-code interface that makes it simple for businesses to send messages to mobile devices across a range of messaging systems such as SMS, voice, email and social media.

Disclosure: The writer holds shares in Whispir.

Image: Whispir mobile phone messaging.