Main Sequence Ventures has achieved a first close of $450 million for its third fund, taking the deep-tech investor past the milestone of $1 billion in funds under management.

Commitments to the new fund have come from investment institutions including industry super funds Hostplus and NGS, wealth management firm LGT Crestone, Morgan Stanley Wealth Management, Singapore government investment firm Temasek, Australian Ethical Investment, Daiwa Securities Group and environmental protection charity The Grantham Foundation.

The funds returning and new investors include top tier international climate investors who, according to Main Sequence, recognise that Australia’s expansive research and innovation capabilities offer a unique opportunity to solve global challenges.

The funding also includes the first half of $150 million committed to CSIRO as stage three of the federal government’s Australian Economic Accelerator program. Main Sequence says this recognises its success in backing and building companies that reflect Australia’s national priorities by investing in ideas that will diversity and transform the nation’s industrial base and economy.

Main Sequence was founded by national science agency CSIRO in 2017 and has backed 53 companies including Regrow, Advanced Navigation and Q-CTRL. According to Main Sequence, the Australian companies it has supported have created over 2,100 new jobs as their total market value has grown to over $6.8 billion.

The first Main Sequence fund closed in 2018 at $240 million and the second, in 2021, at $330 million.

Main Sequence partner Mike Zimmerman said: “We embark on an extraordinary journey with this fund, guided by two key imperatives.

“First, decarbonisation – we want to ensure more translation of climate research into the solutions urgently needed to address our environmental impact. Alongside this, we are advancing critical technologies central to Australia’s national interest including cybersecurity, to protect citizens and infrastructure, quantum computing, to unlock new possibilities, and advanced semiconductor technology, to fuel innovation.

“Our focus remains on big, global challenges that need scientific backing, patient capital and long-term vision to solve. The community we have created around this mission cares deeply about finding and scaling solutions to planetary problems like decarbonisation, feeding a growing population and enabling the next intelligence leap. Thanks to their support, we have the flexibility and fortitude to back and build breakthrough companies grounded in research and help them actualise their impact for decades to come.”

In addition to seeking out research-based companies working to solve important problems, Main Sequence is also identifying novel research which can be applied to important problems through what it claims is its unique ‘venture science’ investment model. This approach pairs deep scientific knowledge with the industry expertise and capital funding required to develop entire industries and ecosystems around solving global challenges.

Main Sequence partner Gabrielle Munzer said Fund 2 had launched five venture science companies: Endua, Eden Brew, Quasar Sat, Cauldron and Samsara Eco.

“We are keeping up this momentum with Fund 3, pioneering new frontiers in biotechnology and plan to continue co-founding new companies at the bleeding edge of exciting advances in food and fibres,” she said.

“We are continuing to harness the forces of entrepreneurship and research to address the ‘valley of death’. We see incredible promise in pre-seed investments and our involvement with Australia’s Economic Accelerator, CSIRO’s ON accelerator and university accelerators like UNSW Founders’ SynBio10x program means we can deepen our focus on unearthing cutting-edge ideas.”

Daiwa Capital Markets Australia Limited chief executive Susumu Handa said his firm was excited to be the first Japanese investor in Main Sequence. He anticipated the collaboration would help build a bridge between the two countries’ start-up ecosystems.

“We can’t wait to work with partners who have passions for global challenges like decarbonisation, food, healthcare, space and more,” he said.

Hostplus chief investment officer Sam Sicilia said the super fund was pleased to continue its involvement with Main Sequence.

“Deep technology companies have the potential to deliver strong long-term returns on behalf of our members whilst aiming to provide solutions to societal, technological or ecological problems,” he said.

NGS Super chief investment officer Ben Squires said NGS focuses on sustainable investing so was excited to collaborate with an investor that shared the same ethos around addressing global challenges like decarbonisation.

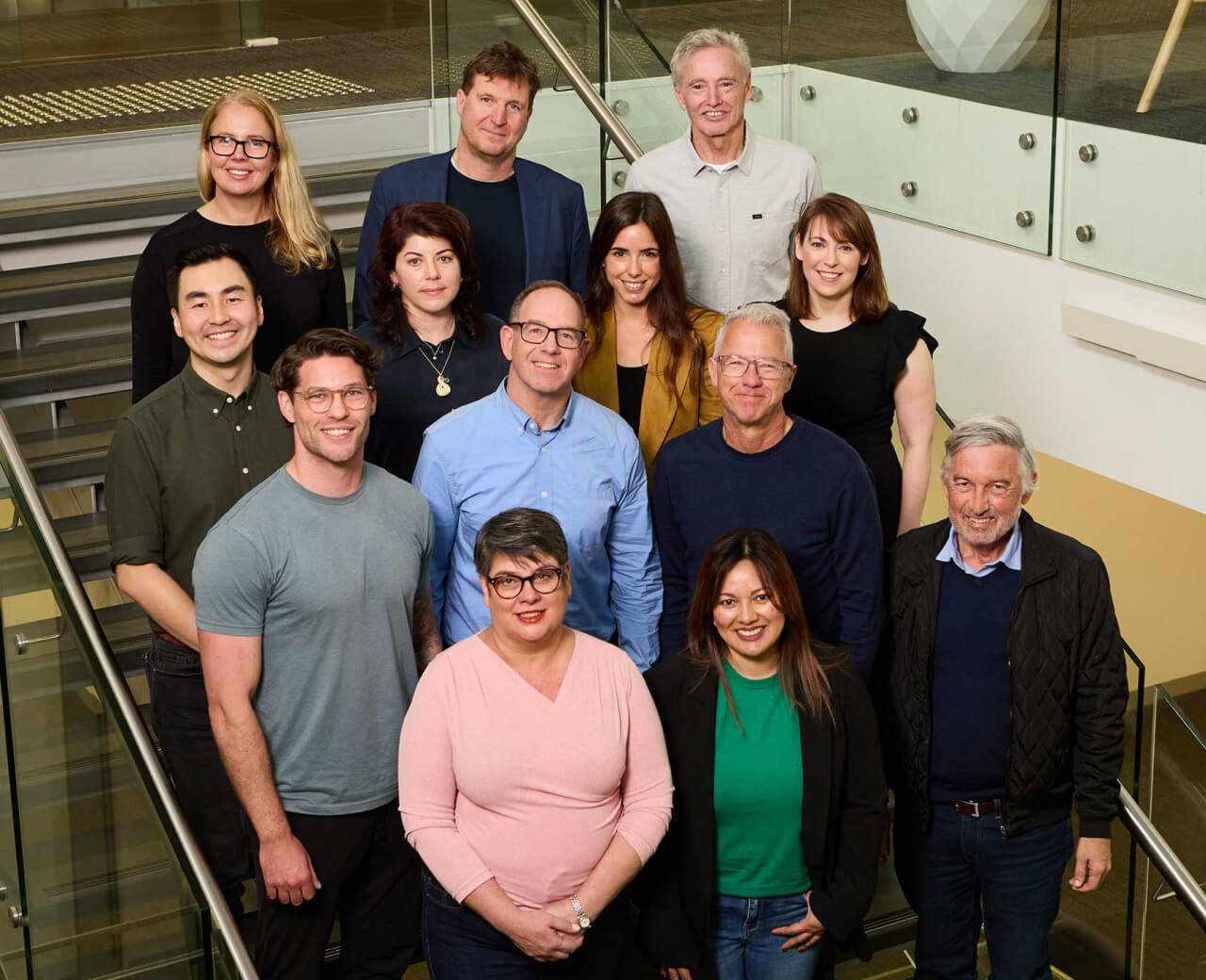

Image: The Main Sequence Ventures investment team.