Latest Private Equity & Venture Capital News

Investors in Australia, the US and India have provided seed funding for a Sydney start-up that has developed an AI-powered tool to identify faults in software products.

Full storyUS investment creates new tech unicorn

12 Feb 2026 - Investment activity

Investment from a Silicon Valley growth capital firm has boosted a Sydney technology company to a billion-dollar-plus valuation.

Full storyOverseas investors have led an $80 million growth funding round for a Mebourne software company that provides demand-driven valuations for cars.

Full storyA global private capital firm has led a $14 billion debt package for an innovative Australian data centres developer.

Full storyA First Nations-led plantation forestry initiative in the Northern Territory is to backed by the federal government-backed Clean Energy Finance Corporation and private capital.

Full storyA venture-backed data centre developer has received a $100 million investment from an ASX-listed construction industry company.

Full storyDuo form new growth investment firm

05 Feb 2026 - News

A former investment banker and a growth sector investor have joined forces to launch a Sydney-based growth capital investment firm.

Full storyAn Australian private equity firm is to acquire an Asia-Pacific regional pharmaceutical business for $2.37 billion.

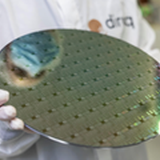

Full story$20 million in federal government funding has been committed to a $75m target current fundraising round for a start-up that is attempting to use current silicon chip manufacturing technology to simplify the develpment of a quantum computer.

Full storyValue of venture exits up 62% in 2025

02 Feb 2026 - News

The value of Australian venture capital exits rose by 62% in 2025 making it the strongest year for exits since venture valuations turned down sharply in late 2022.

Full storyA private equity firm is to exit an outdoor advertising company for $850 million generating more than 100% net return on investment over a five-year hold period.

Full storyA leading industry superannuation fund has taken a stake in its administration software provider in a down round.

Full storyA US specialist software venture capital firm has led a $32.5 million Series A investment round in a scale-up that offers an artificial intelligence driven program to manage the work of in-house legal teams.

Full storyA Sydney venture capital firm says its partial exit of an investment in a cyber security business has taken its fund's return over 3x invested capital.

Full storyThe federal government-funded National Reconstruction Fund (NRF) has led a $57.8 million funding round which will be used to scale up a company which is producing autonomous electric vehicles for industrial use.

Full storyA venture-backed head lice treatment has been sold to a US pharmaceutical company for $2.59 million more than 25 years after the product was initially approved by the US Food and Drug Administration (FDA).

Full storyA South-East-Asia regional venture firm has provided a $20 million credit facility to an Indonesian technology scale-up that is backed by a leading Australian firm.

Full storyA private equity-backed construction tendering online platform has acquired a European business to accelerate its international expansion.

Full story$4.64bn acquisition will take private capital firm into secondaries

24 Jan 2026 - Investment activity

A $4.64 billion acquisiton will take a global private capital business into the secondaries market which is expected to more than double by 2030.

Full story$81m growth capital for legal tech

23 Jan 2026 - Investment activity

A leading Australian venture firm has led an $81 million funding round for a New Zealand-founded legal tech scale-up now based in San Francisco and gaining international traction.

Full story- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110