Technology-specialist private equity firm Potential Capital has raised a second fund at its hard cap of $635 million.

Potentia, which is led by former Archer Capital managing director Andrew Gray and former MYOB chief executive Tim Reed, had sought to raise $500 million for the fund.

The substantially over-subscribed capital raising takes the Sydney-based firm’s funds under management to over $1 billion.

Announcing a first and final close on 15 June, the firm said: “In an almost wholly virtual fundraise, the fund saw strong support from a diversified group of both new and existing institutional investors, with high conviction on Potentia’s robust market position and experienced team. Fund II investors include a mix of asset managers, consultants, insurance companies, family offices, foundations, fund-of-funds and superannuation schemes from the US, Europe, Australia, and Asia.”

Potentia said it plans to build on its reputation as the leading Australia and New Zealand growth capital and buy-out manager focused on software and technology-enabled businesses. The company focuses on investments in Australian and New Zealand based middle market technology companies with proven business models and significant growth potential.

Potentia anticipates that the new fund will have a stronger focus on New Zealand-based companies. Late last year Potentia appointed experienced private equity investor Kerry McIntosh as its senior adviser in New Zealand. Earlier this year, Potentia investee digital commerce business Commerce Vision acquired New Zealand company Opmetrix. Potentia also plans to appoint an executive in Singapore to scout for Asia-based bolt-on opportunities.

To date, Potentia has completed nine platform investments and eight bolt-on transactions. These have included global mining software provider Micromine, instore terminal integration software and online payment gateway services provider Linkly, and specialist B2B e-commerce platform technology company Commerce Vision.

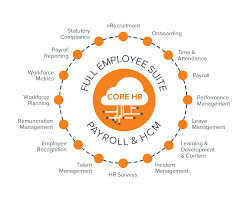

In February 2021, Potentia achieved an impressive 16.4x invested capital exit of its early buy-and-build strategy investment in Ascender with the sale of the business to Ceridian (NYSE/TSX: CDAY) (APE&VCJ, Mar 2021).

Potentia, 5V Capital and other investors acquired Talent2 Human Resources Managed Services, part of recruitment business Talent2, in late 2015 and re-named it Ascender. About a year later, Ascender acquired the Australia and New Zealand business of international human resources and payroll technology services business NGA Human Resources. Further bolt-on acquisitions followed.

Late last year, Potentia exited compliance software technology provider CompliSpace with the sale of the business to UK company Ideagen (FTSE AIM: IDEA). That sale returned Potentia 4.7x invested capital.

Founder and managing director Andrew Gray said the firm is continuing to see a strong pipeline of activity and expects to close the first platform deal, financed by Fund II, before the end of 2022.

“We are extraordinarily proud and grateful for the support LPs, both new and existing, have shown us through this fundraising,” Gray said. “We founded Potentia believing that a sector specific focus to growth and buyout investing in the Australasian market would allow us to form deeper partnerships with management teams, drive faster transformation and ultimately deliver superior returns – it is great to see so much support for this vision.”

London-based Asante Capital Group acted as Potentia’s exclusive global fundraising adviser with Herbert Smith Freehills acting as legal adviser for establishing the fund and EY as tax adviser.

Image: Payroll and HCM technology company Ascender provided Potentia with an impressive first exit.